July 2021 Market Update

Mixed Signals

“True genius resides in the capacity for evaluation of uncertain, hazardous, and conflicting information.”

— Sir Winston Churchill

We arrive at the midway point of 2021 with an interesting set of data points to ponder. The economy in the US is almost fully re-opened and shows signs of surging demand while Europe, Japan, and other developed markets move forward at a slower pace. Emerging nations continue to struggle with COVID-19 and face a difficult immediate future as new variants spread while they wait on the flow of available vaccines to increase.

Interpreting economic signals and their implications for the performance of various asset classes is always challenging, but it is even more perplexing when signals seem to be in real conflict. There are a host of mixed signals in the markets and economy today, and we will highlight three that stand out to us: 1) significant current inflation but falling US Treasury yields; 2) elevated unemployment but complaints from firms that they can’t fill openings; and 3) equity markets that are expensive on an absolute basis but attractive when compared to fixed income.

Market Update

The US equity market continued to grind higher in the quarter, and we experienced a slight reversal of the rotation between the value/growth and large-cap/small- cap dynamics that have held since October. Growth outperformed value and large firms did better than smaller firms for the first time since the summer of 2020. This is unlikely a sign that tech and related sectors are going to re-emerge as the main driver of market performance, but more a natural ebb and flow that occurs in markets over the short run. We remain convinced that a balance between value and growth is prudent at this stage in the cycle.

One trend that has continued is the superior performance, in dollar terms, of US equities versus international markets. The US continued to outperform both emerging and developed indices in the quarter, continuing a thirteen-year run of better returns in the United States. There are a variety of reasons for this trend, but one of the most critical is the profitability of successful technology firms that are a significant part of the overall market capitalization in the US. This means that US markets have more exposure to companies that have high margins, low capital intensity, and highly predictable earnings. Those characteristics garner a higher multiple from investors and support higher P/E ratios. The US market has always traded at a P/E premium to non-US markets, but the quality of earnings that American firms now produce has supported an expansion in that gap. Given the challenges that many international economies still face from COVID-19 and the limitations many have in supporting their economies through aggressive fiscal and monetary measures, we remain overweight the US equity markets versus other available candidates. Although true that the EAFE developed market index has a higher exposure to value sectors such as financials, we prefer to get exposure to the value theme through domestic markets.

The US equity market remains expensive by some valuation metrics with a forward P/E ratio of 21.4 versus a long-term average of 17.3. This is a slightly lower reading than three months ago due to strong growth in forecasted earnings for S&P 500 firms. We have noted in the past that this elevated multiple looks less frightening when compared to the yields available in fixed income markets. With the 10 year US Treasury bond again yielding less than 1.5%, the relative valuation of equities on an earnings yield basis is in line with the 30 year average. This relative valuation continues to support equity prices, especially with the surprising drop in rates seen in this quarter. With inflation running hot and additional government spending expected over the next few years, there was a strong consensus that interest rates must move higher throughout this year, perhaps even reaching the 2% threshold. As is often the case, the consensus has so far been wrong and Treasury rates moved lower after the Federal Reserve noted they may have to begin to taper bond purchases earlier than previously expected.

In the short run, the path of interest rates will drive volatility in US equity markets. The relative value issue is important to investors, and if bond yields move back up, which seems likely, then expect stock market volatility to increase as market participants adjust their valuation frameworks in real time. We are less concerned with these day-to-day moves and feel that higher rates and less Fed support is ultimately a positive sign that our economy is returning to normal and no longer needs the extraordinary support it received during the pandemic.

The State of the U.S. Economy

We continue to see the US economy emerge from the lockdown. GDP growth has continued to improve as the labor market recovers, but after the current surge we expect to see more modest growth for the remainder of this year and 2022. This is not shocking, since you only re-open the economy once, but slower growth may have an impact on corporate earnings, challenging a market priced for perfection. As we put the COVID economy behind us, we would expect to return to the pre- pandemic level of trend GDP growth hovering around 2%.

The two largest issues that require additional comment are the status of the labor market and the outlook for inflation. Both are exhibiting some mixed signals that we will discuss later in this note, and they are linked through one key factor: wage growth.

The unemployment rate continues to decline, but the rate is still expected to remain above 4% through 2022, well above the 3.5% level pre-COVID. There are currently just over 9.3 million unemployed Americans, but there are over 9.2 million job openings in the US. These two numbers are rarely in balance, and how the labor market evolves will have a significant impact on the economy. Most observers, including the Federal Reserve, believe that elevated unemployment is primarily driven by residual COVID fears, lack of childcare, and enhanced unemployment benefits. However, there is evidence that a lack of appropriate skills among the jobless and a geographic mismatch between openings and the unemployed are also a significant factor. We should begin to see which factors are more relevant in the fall as the shorter term factors begin to fall away.

Inflation has obviously been elevated this year. Some of the elevated headline readings are due to year-over-year comparisons with the depths of 2020. Much of the rest of the gains are being assigned to increased demand for travel (airline tickets and rental cars), automobiles (both new and used), and energy. The Federal Reserve and other prominent commentators continue to call this inflation “transitory” due to short-term factors including supply chain disruptions, shipping delays, a semiconductor shortage, and a disjointed labor market. All of those are expected to normalize, thereby allowing inflation to correct towards the 2% level the Fed targets.

Unfortunately, there is a looming reversal in several structural trends that may pose a problem to the consensus inflation call. Since the fall of communism and the rise of China in the late 1980’s, we have seen several forces act as moderators of inflation. Globalization has enabled lower-cost production of goods and allowed supply chains to stretch across the globe; central banks have exercised their independence and have kept monetary policy focused on low inflation; and workers in developed countries have seen their wages stagnate in the face of competition from overseas. All three of those trends now seem to be breaking down. Globalization is in retreat and the demographic picture in China will limit its ability to be the low-cost workshop to the world; the Federal Reserve, ECB, and other central banks have firmly stated they are comfortable with higher inflation and seem to have politicized their work; and workers in the US have seen their bargaining power improve and are demanding higher wages. There is certainly a case to be made that inflation may be more resilient than expected and that wages in particular will be a good guide for how this question plays out.

Conflicting Data Points

It is always hard to interpret current economic and market data in an effort to position portfolios and predict where the economy is heading. It is even more difficult when critical data points give conflicting readings and traditional relationships seem to be telling a different story. We highlight three meaningful items below:

- Treasury Yields have declined in the face of elevated inflation readings

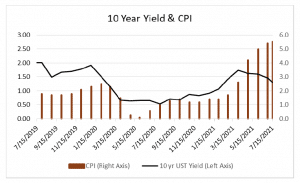

Recent inflation prints are some of the highest seen since the 1980’s. The economy has re-opened and everything seems to be more expensive. The Federal Reserve has said they will tolerate slightly higher inflation, but stand ready to reduce support to the economy if it appears more permanent. Given this backdrop, one would traditionally expect to see higher long-term rates. We have actually seen the exact opposite with 10 year yields falling toward 1.30% in July while CPI has surged higher.

- Both the unemployment rate and job openings remain elevated

In the US the number of unemployed is almost exactly equal to the number of job openings. Something is preventing those positions from being filled. If the short-term, post-COVID factors are holding us back, then the labor market will begin to balance in the fall. If more persistent structural labor market issues are the culprit, then we may be saddled with slower growth and higher wages in the future. That is a recipe for a dreaded hint of stagflation, a situation where the economy plateaus while inflation rises.

- Absolute equity valuations are expensive, but relative valuations seem attractive

For several years, equities have appeared expensive using absolute measures such as the price-to-earnings ratio, but markets have continued to march higher. Strong corporate earnings have provided some of the momentum, but the real support has come from ultra-low interest rates. When the stock market is priced on a relative basis, where the yield on various fixed income assets are compared to the earnings yield of the equity market, it actually appears attractive. The table on the left shows that on an absolute basis stocks have almost never been more extended, but on a relative basis they are cheaper than average. This dichotomy shows why the level of interest rates has never been more important to equity markets.

Translating Thoughts into Action

We continue to emphasize the three tactical themes outlined below and have remained focused on implementing these views in portfolios. As a reminder, those themes are:

1) Maintain cash reserves for 18 months of spending and opportunistic investments.

2) Balance the allocations to growth and value in equity holdings.

3) Seek yield in private credit opportunities in real estate and direct lending.

In addition to these three main actions, we continue to monitor the following areas for additional investment: 1) an active small and mid-cap US equity allocation, 2) additional investment in emerging market equities, and 3) additional investments in private strategies that stand to benefit from the global trend towards more sustainable growth. As those opportunities and others continue to evolve, we will consider how they fit into our current allocations.

Looking Through the Noise

There are even more crosscurrents than usual in markets today. Consensus expectations are projecting a solid recovery with strong corporate earnings, well contained inflation, slowly rising interest rates, and a smooth road out of the COVID economy. It is highly unlikely that we are going to get that lucky.

We will continue to monitor the important data points that seem to be in conflict today and will try positioning ourselves to continue to take advantage of the current environment. We do not profess to have the genius that Sir Winston Churchill mentions, but believe we have the capacity to sift through the information available and draw appropriate conclusions.

Also, as a final note, we made a significant change in the second quarter by removing Met West as one of our active value managers. The portfolio manager leading their effort retired from the firm, triggering a formal review of the new team. Ultimately we concluded that the value portion of our portfolios would be better served by a combination of Aristotle Capital Management, our other active value manager, and the index. This mirrors what we hold on the growth side with Sands Capital and the growth index. This change does have a capital gain impact for most accounts, and your trust officer has more detailed information on the specific impact on your holdings.

We hope you have had an enjoyable first half of 2021 and that your summer is going well. We look forward to visiting, hopefully in person, very soon.

Sincerely,

Steve Sprengnether

President & Chief Investment Officer

scs@legacytrust.com

Brad Bangen

VP, Head of Private Markets

bbangen@legacytrust.com

Laurence Unger

VP, Head of Public Markets

lunger@legacytrust.com