Legacy Trust Market Commentary | May 2023

The Tide Goes Out

“When the tide goes out, we find out who has been swimming without a bathing suit.”

– Warren Buffett

It has only been a year since the Federal Reserve began aggressively raising interest rates to try and reduce inflationary pressure in the economy. The central bank abruptly ended almost fifteen years of free money that distorted financial markets as investors were pushed into riskier asset classes since yields in safer securities were effectively zero. The end of zero interest rates forced investors to reset valuation levels, and equity and fixed income markets corrected sharply last year. Even harsher returns were absorbed in more exotic corners of the financial universe such as special purpose acquisition companies (SPAC’s), cryptocurrencies, and speculative venture capital. These initial corrections were expected by investors to some extent, but then in the first quarter of this year a mini banking crisis was driven by an unlikely culprit: US Government bonds held by Silicon Valley Bank.

The failure of Silicon Valley Bank was, in large part, caused by mark-to-market losses on US Treasuries and US Agency backed mortgage bonds that had been purchased in a period of ultra-low interest rates. The bonds in question had no credit risk. However, they had long maturities, also known as duration, which caused them to experience significant mark-to-market losses.

If SVB could have held them to maturity they would have been fully repaid, but the need to fund deposit withdrawals forced them to sell at the worst possible time.

This episode is a reminder that even an asset that is risk free can be bought at the wrong time and at the wrong price. It is also a reminder that other unrealized losses that accumulated during the long zero interest rate regime have yet to be identified. The real impact of higher interest rates are only now being felt, and all of the investors and institutions that were skinny dipping in the frothy years have not been identified. Yet.

Markets have gotten off to a strong start this year, but headwinds remain as elevated inflation is still a threat the Federal Reserve is determined to tame. We seem to be at a point where equity markets are pricing in an optimistic outlook while bonds are indicating slower growth and a recession. This tension between the two primary asset classes likely signals rougher seas ahead. A rising tide driven by low interest rates raised all boats, but now that the cycle has turned, we are moving against the current. Navigating the path forward will be a challenge.

Market Returns

- US equity markets had a strong quarter even with the threat of a banking crisis centered on regional US lenders after the failure of Silicon Valley Bank (SVB). Results were driven by significant gains in the technology, communication services, and consumer discretionary sectors. This helped the growth index significantly outperform the value index.

- International developed equity markets exhibited similar performance to the US and benefited from a slight decline in the US dollar.

- Emerging markets provided a more mixed picture as strength in China was offset by negative returns in India and Brazil.

- Fixed income markets benefited from a drop in longer-term interest rates. The US ten-year treasury yield dropped from 4% at the start of the year to under 3.5% at the end of March. Even the two-year treasury, which is more closely tied to the path of the FED funds rate, dropped over the quarter by almost 0.4%.

- This drop in yields suggests that fixed income markets are anticipating slower growth, a potential recession, and the need for the Federal Reserve to cut rates in the next year. That view is at odds with both the Federal Reserve’s clear statement of intent to continue raising rates and recent equity market performance. These differing perspectives will be resolved as we move through this year.

Equity Market Fundamentals

- Equity market returns are driven by corporate earnings • and the multiple that investors are prepared to assign

to those future earnings. The price to earnings multiple (P/E) is impacted by many factors over time, but interest rates and inflation are significant reference points to consider. All else being equal, higher interest rates and inflation lead to a lower P/E ratio. • - The P/E in the US has been elevated over the past • cycle by extremely low interest rates. As rates increased last year the ratio dropped from 21 to 15, closer to its historical average.

- Earnings estimates for 2023 have been dropping since early last year and have fallen about 12% in the past few quarters. The recent market rally has brought the P/E back up to 18.2 even in the face of persistent declines in earnings expectations.

- Recent returns seem at odds with the path of earnings. Markets often bottom before the end of a recession but not before one has even started.

A Stretched Consumer and Banks Under Pressure

- US Consumer spending is critical to GDP growth and corporate earnings. Consumer consumption drives 68% of US GDP.

- While employment has been robust, and wages have grown they have not kept up with inflation. Savings grew during the pandemic as government programs, strong employment, and lockdowns forced consumers to save money and allowed them to pay down credit card debt.

- The savings rate has trended well below longer-term averages and credit card balances have been growing since mid-2021. This seems to be an indicator that the US Consumer is starting to face personal financial stress, which could limit spending growth.

- Recent stress among regional banks and declining fundamentals in several real estate asset classes are impacting the availability of credit to real estate assets. This will likely present an attractive entry point over the next few years for private lending opportunities.

Brief Comments on the Debt Ceiling

- Treasury Secretary Yellen recently indicated that the government would need to issue more debt around June 1st in order to avoid a default.

- Congress and the President have just started to engage in serious negotiations.

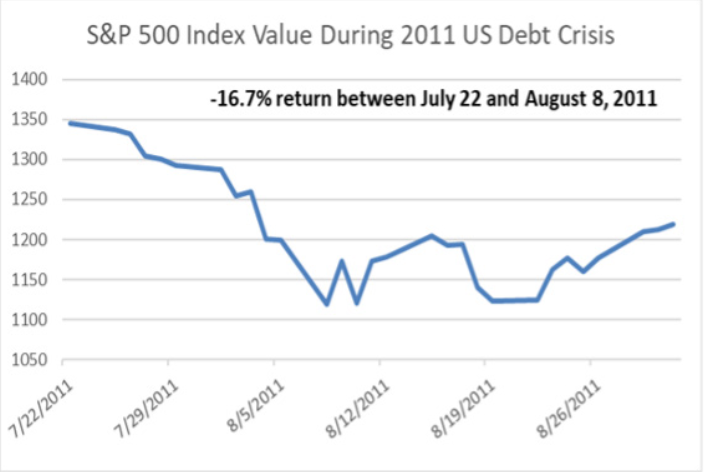

- The current situation resembles the crisis in 2011.

- The US equity market has not reacted to the possibility of default, but the short-term US Treasury debt market has seen an increase in T-Bill yields that mature in June.

- In 2011 the S&P 500 declined 16.7% in the two weeks leading up to a last-minute deal to avoid a default.

- As tension builds riskier assets will likely sell-off.

- Investors who have short-term distribution needs should reserve enough capital to avoid forced selling in a crisis. Portfolios that are heavy on cash and underweight equities can use the turmoil to add positions at a discount.

Navigating a Change in Tides

While financial markets often react quickly to Federal Reserve actions, interest rate increases start to have a noticeable impact on real economic activity about a year after they are initiated. We are just now entering that window, and the Silicon Valley Bank situation is a reminder that we should expect additional unforeseen ramifications as we sail through this transition to a higher rate environment.

Portfolio positioning is never a simple matter but is especially difficult when equity and fixed income markets are providing conflicting signals. With short-term interest rates moving above 5%, the US consumer showing signs of stress, and corporate earnings challenged, the recent rally in stocks seems premature. For accounts taking current distributions, this is a good environment to trim from equity holdings and maintain funds in cash to meet near-term spending needs. Treasury money market funds currently yield above 4.5% and are an attractive asset to hold for funds earmarked for spending.

Given the stress on banks and the tightening of credit standards we believe the next few years should be an excellent time to step in and be a lender. There are some select public market opportunities in this space but we feel the most attractive opportunities will be available in private markets. Direct corporate loans, structured corporate credit, and real estate credit are all areas we have exposure to in LTC Realty Partners III and LTC Private Credit, but we may look to add to those positions soon in additional vehicles.

We hope you are having a wonderful spring and look forward to visiting with you soon. Please feel free to contact us at any time to discuss any questions you may have.

Sincerely,

![]()

Steve Sprengnether

President & Chief Investment Officer

scs@legacytrust.com

![]()

Brad Bangen

VP, Head of Private Markets

![]()

Laurence Unger

VP, Head of Public Markets

lunger@legacytrust.com