Where We Stand

“You can’t really know where you are going until you know where you have been.”

– Maya Angelou

The first half of 2023 has been a remarkable one for financial markets. After a challenging 2022 driven by rapid adjustments in asset valuations due to a transition from a zero-interest rate environment to one with a more expensive cost of capital, expectations were muted for equity market returns. The Federal Reserve (the Fed) was clear on its intent to continue raising rates, the economy appeared to be slowing, and the US experienced a mini banking crisis in March. Such conditions did not seem a likely foundation for robust stock market returns.

Investors largely shrugged off the negative headwinds and focused on the longer-term potential returns after last year’s adjustment. The broad market has been led by spectacular growth in several large capitalization technology firms expected to benefit from advances in artificial intelligence (AI) while sectors such as energy, utilities, and financials have struggled. In essence, we have seen a rapid shift in sentiment with some of the worst performing industries from last year enjoying strong stock price appreciation this year despite their murky immediate fundamentals. Markets are forward looking and often start to rally prior to the outlook becoming clear, but in an economy that is just now absorbing the impact of substantially higher interest rates and persistent inflation, the exuberance may seem premature.

After the surprising strength of this year’s rally, it is important to revisit the market expectations that are driving investment decisions. If we can decipher what current prices and valuations imply for the future path of rates, inflation, and growth, we can determine where asset prices may be disconnected from the road ahead. This can help us to identify opportunities and risks in portfolios and position them as best we can given today’s starting point. The first step in successful land navigation is determining the precise coordinates of your current location, only then can you proceed to the next target.

Recent Market Returns

US equity market performance in the past six months has once again been dominated by large capitalization technology stocks. The year to date returns for Apple +50%, Microsoft +43%, Meta +138%, Alphabet +36% and NVIDIA +190% have contributed 74% of the S&P 500 Index total return. The impact of the outsized returns of those companies is especially noticeable when comparing the returns of growth indices to value indices and when comparing the returns of the equal-weighted version of the S&P 500 to the more broadly followed market capitalization weighted S&P 500. These measures tell the same story. If you did not have exposure to those top performing S&P 500 companies, then you have had a dramatically lower return so far this year.

Equity Market Fundamentals

Those large companies generate substantial revenue, earnings, and free cash flow, and therefore deserve to be highly valued. However, most of their recent gains seem to be driven by investor enthusiasm for future, undefined profit from new offerings driven by generative AI and not from services in this immediate product cycle. These companies may continue to lead the market higher, but fundamentals will eventually have an impact on their share prices. Without more clarity about the specific earnings benefit this exciting new technology will provide, it is likely that sentiment may cool for these firms. The index will then need support from the other 495 stocks to continue to move higher.

The US has continued to outperform international markets even though the dollar has been relatively flat this year versus a basket of other currencies. Developed markets have produced a solid 12.1% return so far this year but lack the extra punch provided by the large US tech sector. Non-US developed markets in Europe and Japan tend to have higher market cap weightings to value sectors such as financials, industrials, and energy than US benchmarks, so in an environment where growth is outperforming value, the US tends to lead. Emerging markets have been relatively weak, largely due to a disappointing recovery in China, but countries such as Brazil and India have exhibited stronger returns than the broader index.

Fixed income markets had a weak second quarter and modest returns so far this year. Short and long-term yields have risen noticeably since March 31st, forcing a negative total return for the quarter even though investors are earning more income today than they have in years. Money market funds continue to draw capital from both bank deposits and bond funds since they now sport yields above 5% with immediate liquidity and no duration risk. Cash is a real investment again, and, as the Fed continues to move short rates higher, it will become a tougher competitor versus other asset classes.

Market Expectations

As we take a moment to evaluate where we stand after a surprising start to the year, it is useful to assess what market fundamentals imply about investor expectations for key items such as earnings, interest rates, and the path of growth. There is no perfect measure for discerning what the market expects to happen but spending some time on the details can provide insight into potential paths forward.

Interest Rates & Inflation

Expectations in the marketplace are deeply divided around the path of interest rates. The Federal Funds rate is the fundamental input that determines asset pricing, and expectations of the future level of this critical input drive return forecasts and current market prices.

Since the Fed began raising interest rates, it has consistently reiterated a determination to lower inflation to its 2% target as quickly as possible. Now that inflation has likely peaked, many marketplace participants appear to be pricing in significant rate cuts starting later this year, but the Fed’s “dot plot” tells a different story. The “dot plot” is published after every Fed meeting and shows board members’ expectations for future rates. Private sector analysts and the swap market are both showing a significant gap compared with the Fed’s dot plot forecast. Additionally, the severe inversion of the yield curve tells us that fixed income markets are also anticipating that the Fed will begin cutting rates in the near future.

The Fed will only feel the need to cut rates if inflation rapidly returns to 2% or there is a major recession. While inflation is falling, it is still elevated. A statistic Chairman Powell has repeatedly referenced, the core services ex shelter index, has started to moderate but is still well above 4%. There is still substantial work needed to get inflation back to 2%.

GDP Growth & The Labor Market

Consumption drives 65% of US GDP, which means that the status of the labor market, which drives consumer spending, has a large impact on inflation. All else being equal, a tight labor market should support GDP growth and sustain inflation. At some point a weaker market may be required for inflation to continue to decline. The headline unemployment rate is a lagging indicator, but data on hours worked and wage growth can provide a glimpse of where employment may be headed.

Hours worked have drifted lower but appear to be stabilizing at a healthy level while wage growth continues to run above 4%, an elevated level when compared to pre- pandemic levels. Other measures, such as initial jobless claims, have also been trending lower. Based on these indicators, it appears that the Fed’s attempts to weaken the job market have not had much impact yet.

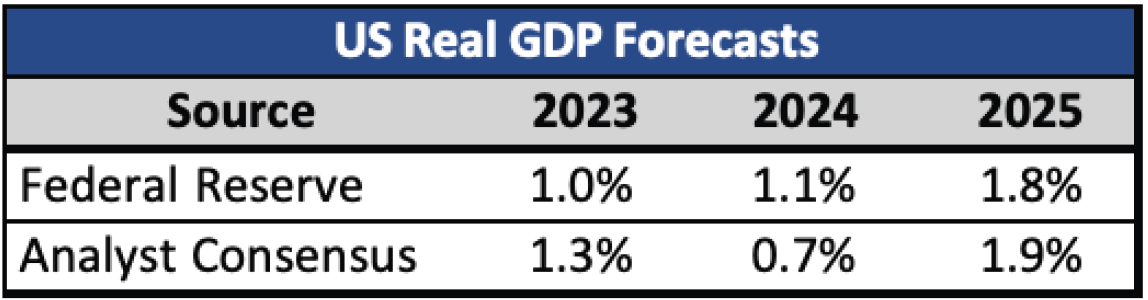

Both the Fed and market analysts expect weak but positive GDP growth over the next few years. First quarter GDP increased at an annualized rate of 2%, and consumer spending indicates the second quarter has likely produced another solid three months of growth. It appears that analysts may be slightly pessimistic on the ability of the US economy to continue to grow as the consumer seems well situated to support at least moderate growth going forward.

Equity Valuations & Earnings

In evaluating the status of equity markets, we must start by looking at earnings and the multiple that investors are willing to pay for those earnings. The forward price to earnings multiple (P/E) is impacted by a variety of factors, but in general there is an inverse relationship between interest rates and inflation and the P/E multiple. Low rates and inflation support above average multiples, which we have seen during the low-rate regime of the past 15 years. On the other hand, higher rates bring the multiple down, which was clear in the 2022 market adjustment when the multiple fell from 21 to 15.

The current forward P/E multiple on the S&P 500 is 19.1x which is driven in part by the aggressive valuations in the largest companies in the index. The top ten companies trade at a 29.3x forward multiple while the remainder of the index is priced at 17.8x. From a style perspective, the Russell 1000 Value Index sits at 14.5x while the Russell 1000 Growth Index is priced at 27.0x. As a reference, the twenty-year average forward P/E for the S&P 500 is 15.5x.

Equity investors seem to be pricing in a swift return to a lower interest rate regime in an economy that supports solid corporate earnings. Hopes for immediate cuts by the Fed are at odds with the Central Bank’s clear statements and would only be implemented if there was a recession severe enough to force a pivot. Such a recession would have a negative impact on corporate earnings that is not currently evident in market prices.

Bringing it all Together

Equity markets are pricing in an expedited return to an environment of low, sustained inflation and reduced interest rates supportive of lofty valuations and aggressive earnings forecasts. Fixed income markets are signaling substantially slower growth, if not a recession, with interest rate cuts. The Fed is adamant about the need to maintain higher interest rates to reduce persistent inflationary pressures. These views are in direct conflict with each other, and it is not clear how they can be reconciled without significant market impact.

The economy and labor market have proven far more resilient to rapid increases in interest rates than most observers expected. Inflation is still a problem that will need additional work to lower to target, and the Fed will continue to pursue that end. Recent statements from the Fed have been clear: short-term rates are going higher, perhaps even to 6%, and will likely remain elevated until the Fed is confident that inflation is tamed. Market prices do not seem to be reflecting that message yet and will likely have to adjust as that reality sinks in.

Positioning for Tomorrow…

Given this tension between markets, we are implementing the following in portfolios in order to navigate these trends successfully:

1) We are maintaining cash buffers to meet distribution needs for the next eighteen months. For portfolios that do not require current distributions, we are targeting a 5% holding in cash equivalents, which are earning an attractive yield and will serve as a ready source of liquidity if an opportunity to rebalance into equities, fixed income, or alternative assets presents itself.

2) Within equities, we are 1) favoring the United States over international markets and 2) balancing growth and value exposures. Given the outperformance of growth stocks year-to-date, now is a good time to add to value strategies and maintain balance between these broad equity categories.

3) We are monitoring opportunities in private credit. Stress in the banking system and a need for companies and real estate owners to manage their capital structures will present opportunities for flexible private credit providers to step in where banks may not lend. These strategies may include direct lending, distressed assets, bridge financing, or structured credit and should be available over the next few years as the impact of higher interest rates flows through various credit markets.

Mixed Messages

Markets have had a remarkable start to the year, and we are happy participants, but fundamental valuations in certain parts of the equity market are stretched, and major asset classes seem to be pricing in very different scenarios. At times when market signals seem contradictory and confusing, it is prudent to stay close to long-term strategic allocation targets. We will remain vigilant and use periods of clarity to add to areas with increased visibility and take advantage of opportunities in less liquid markets that seem more durable.

Sincerely,

![]()

Steve Sprengnether

President & Chief Investment Officer

scs@legacytrust.com

![]()

Brad Bangen

VP, Head of Private Markets

![]()

Laurence Unger

VP, Head of Public Markets

lunger@legacytrust.com