Regime Change?

“I see us moving from what was hyper-exceptionalism to merely exceptional.”

– Marc Rowan, CEO of Apollo Global, on US markets, May 5th ,2025

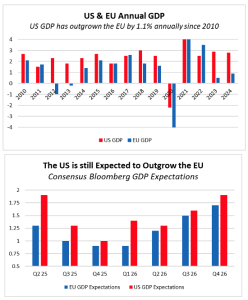

Since the end of the Global Financial Crisis (GFC) in 2010, the macro-economic environment has been dominated by several trends including: 1) solid US GDP growth, 2) sluggish growth from Europe & Japan, 3) slowing growth in China, and, until the past two years, 4) persistently low interest rates and inflation. These economic characteristics, along with the recent rise of Artificial Intelligence (AI), have driven consistent outperformance of US assets, especially large capitalization growth equities and a strong Dollar. Entering this year, the consensus expectation among investors was that these trends were set to continue, and US preeminence would grow under the new administration.

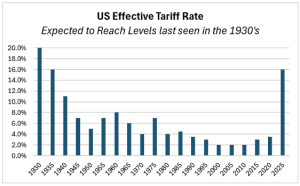

After a tumultuous first six months under the Trump administration, many of these assumptions are being called into question. The aggressive tariff policies that were floated in April caused an immediate negative reaction in financial markets, and our trading partners are clearly struggling with how to respond. While Washington, DC has softened many of the original threats and is negotiating to strike reasonable deals with many nations, significant questions on final tariff levels remain unanswered. In addition to country-specific measures, tariffs on steel and aluminum have already been implemented, and threatened duties on copper, pharmaceuticals, and other items could continue to surprise markets. No matter the outcome, the reality is that trade will face additional headwinds in the future. The global economy is more fragmented today than it was six months ago.

These policy surprises have caused a notable shift in sentiment towards US assets. In the space of six weeks, the consensus seems to have shifted from boundless US exceptionalism to a rush to “sell America.” This shift in sentiment could mark a sudden, persistent reversal in long-standing trends, a slight change of course, or a mere detour as markets revert to their long-standing direction of travel. The resolution of this question will have important impacts on capital markets and investment portfolios.

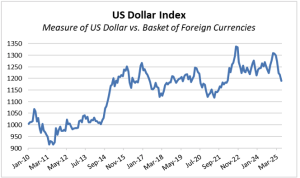

Market results from recent volatility in April show the importance of this issue. Traditionally, when market volatility spikes, capital has flowed into the US, resulting in a stronger Dollar and demand for US Treasuries that drives down interest rates. When markets sold off this spring, the Dollar weakened, and Treasury yields rose as investors flocked to foreign bonds and gold. In the weeks after “liberation day,” the US was not the safe haven that it had been in other times of market stress. If this is a signal of a new regime in markets, it would have profound effects on future portfolio strategy.

Since those volatile few weeks at the start of the second quarter, US markets have found their footing and largely recovered. The Dollar has stabilized versus a basket of international currencies, Treasury yields have dropped, and US equity markets matched international returns in the past few months after a rough start to the year. The path forward remains uncertain, and considering the possibility that we are entering a new market regime is a key topic to explore.

Recent Market Activity

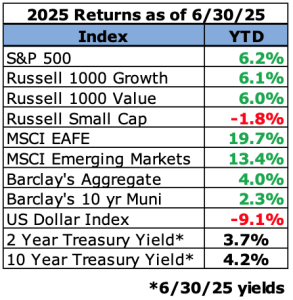

As noted above, several trends reversed in the first half of 2025. International stocks, both developed and emerging markets, significantly outperformed the S&P 500. Approximately half of their outperformance was due to Dollar weakness, which adds to returns as foreign currencies are converted back to USD, with the other half coming from price appreciation. US equities had an extremely volatile six months, reaching an all-time high in February, then dropping almost 19% in the wake of tariff announcements in April, before bouncing back to new highs and posting a more than respectable year-to-date return of over 6% by the end of June. Within the US market, value sectors were outperforming for much of the year until the last few weeks of the quarter when continued excitement surrounding AI spurred a rally in growth and technology firms that allowed growth to match the value index.

Fixed income markets posted strong total returns for the first half of the year, but these figures mask the volatility seen in rates over the past six months. The ten-year Treasury bond has traded with a yield as high as 4.8% and as low as 3.9%, a remarkably large range in a period when the Federal Reserve hasn’t lowered rates, and we have not experienced a financial crisis. Even the less volatile two-year Treasury has traded as high as 4.4% with a low of 3.6%. Both have settled in a tighter band over the past few weeks around the 4.2% and 3.8% levels respectively. Corporate bonds continue to trade at tight spreads versus Treasuries, indicating that investors are comfortable with the credit quality of corporate borrowers.

International fixed income markets have been direct beneficiaries of Dollar weakness. The index covering international bonds gained 10.0% in the first two quarters and emerging market bonds were even stronger, registering a 12.3% return. International bonds have produced almost no return the past ten years. The trailing 10-year annualized return on the global bond index is 0.6% even with the strong start to 2025, but sudden changes to the value of the Dollar can have an outsized impact on global bond markets.

Commodity markets have also been volatile. Gold rallied almost 28% in the past six months and now trades at record levels above $3,330/ounce. Oil prices have declined this year, even with the recent conflict between Iran and Israel. Crude oil currently trades around $66/ barrel. Copper prices have spiked higher since the administration announced a possible 50% tariff on this key industrial metal and show the potential impact of tariffs on the price of goods in the US. Domestic mines produce approximately 50% of annual US copper demand, and it can take a decade to open a new mine. Immediate tariffs will raise prices until more local supply can be created, and that has the potential to raise costs for components used in everything from automobiles to apartments.

Possible Headwinds Ahead

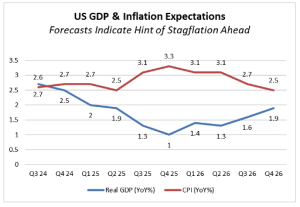

The economy and markets have been able to adjust to new tariffs and the uncertainty regarding the final level of import duties that the US is going to impose, but there are headwinds gathering that may limit growth and spur inflation as policies are fully implemented and consumers adjust to a new environment. Analysts expect GDP growth to drop to 1% by the end of this year, just above stall speed for our economy. At the same time, inflation is expected to move above 3% as tariffs flow through to consumer prices in the fourth quarter. This hint of “stagflation” places the Federal Reserve in a tough spot since its ability to cut rates to support the economy could be constrained by inflation running at 3%.

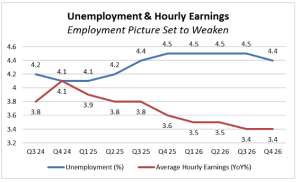

In conjunction with slower growth and higher inflation, the labor market seems to be weakening. Unemployment is expected to drift higher over the next few quarters, and wages will weaken. Issues in the labor market will be another headwind for consumers that are also facing a resumption in student loan payments this summer and elevated interest charges on record credit card balances. In addition, a collection of smaller issues could pose challenges to GDP and corporate earnings growth in the next few quarters, including retaliatory tariffs from foreign governments, and fewer tourist visits to the US.

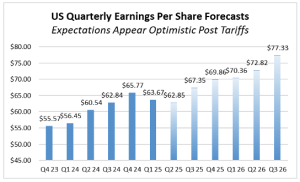

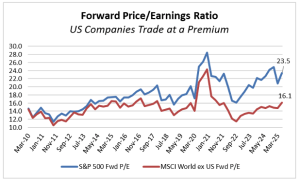

The economy has shown resilience and is expected to grow through these challenges, but the momentum may be muted. Stock market analysts still anticipate robust earnings per share growth over the next few quarters, but this collection of issues may result in lower revenues and larger expenses hitting profit margins. In this environment, it could prove difficult for firms to hit these optimistic expectations. With the S&P 500 priced at a forward price to earnings ratio (P/E) approaching 23x, any earnings disappointments will be a challenge for equity market performance. The challenges ahead do not appear insurmountable, but when markets are priced for perfection, even marginal reductions to the outlook can pose a hurdle for the market to clear.

An Inflection Point?

While the US equity market likely has some near-term issues to deal with, they appear to be a collection of non-recurring issues that will fade into next year. The more critical strategic question is trying to determine if the trends that have been dominant since the GFC have reached an inflection point. The key asset allocation question is whether US equities can continue to significantly outperform international stocks.

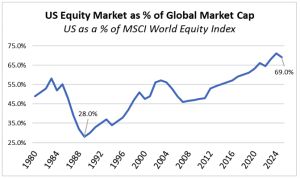

At the end of 2024, US stocks were 70% of the market capitalization of the MSCI global benchmark. While that percentage has declined slightly this year, our local market is near an all-time high as a percentage of all public stocks in the world. Since 1988, US equities have generally outperformed international markets except for the 2001 – 2008 period after the internet bubble burst in 2000. Since 2010, US equity outperformance has been aided by the Dollar as our currency has strengthened since the GFC against a basket of foreign currencies.

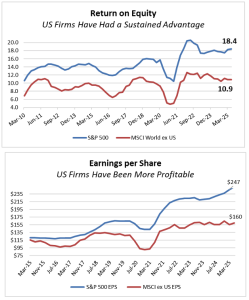

However, a strong currency is not the main reason US stocks have outperformed. Companies based in the US have posted stronger earnings and produce a better return on equity than their foreign competitors. Our market does benefit from having an outsized exposure to technology and software firms such as NVIDIA and Microsoft that are in industries with higher profit margins than other sectors, but those companies are based in the US due to our deep capital markets, support for entrepreneurs, lighter regulation, and more flexible labor systems. The US also has a better demographic profile than other developed markets and even some emerging economies, most notably China.

The structural advantages the US enjoys have resulted in better GDP growth than our developed market peers. Using the European Union (EU) as a comparison, the US has grown an average of 1.1% faster than the EU over the past fifteen years. That may seem unremarkable, but compounding that difference over a sustained period of time is substantial. The value of all goods and services in the US is estimated to be $29 trillion while the EU stands at $19.5 trillion.

The US is far from perfect, however, and other economies are attempting to jump-start growth. The EU recently pledged to increase budget deficits to support an increase in defense and infrastructure spending, and that effort will support some additional growth in Europe, but the scale is limited. The Eurozone still has substantial labor, environmental, and climate change regulations that limit the ability of its private sector to thrive. The EU also has a fragmented banking system and smaller capital markets that are less able to support growth and investment. Even with recent policy announcements, the US is still expected to outperform the next few years.

Recent narratives would seem to suggest that the US has given up our economic advantages in the pursuit of a radical trade agenda, but that narrative ignores the durable advantages that the US economy enjoys. Those advantages do not mean that our capital market returns must always outperform. After this long, strong run in US equities, our market is expensive. The MSCI world ex- US index trades at a 30%+ discount to the S&P 500, a significant gap. While the S&P has historically traded at a premium to the rest of the world, the spread today seems excessive. It will likely narrow.

Portfolio Implications

The S&P 500 as a percentage of the global market cap has likely peaked and should rebalance lower over the next few years as investors seek to broaden their exposure away from expensive US stocks and benefit from a slightly weaker Dollar. We see this shift as gradual and likely taking years, not quarters. We have been concerned about stretched valuations in US growth stocks for quite some time and have discussed in previous letters how we are actively trimming from growth and allocating to less expensive value sectors. At this point in the cycle, we will expand that rebalancing effort to include some additional investments to our existing international holdings. We view this as a marginal shift, not a significant change in approach.

We also have an attractive pipeline of new investment opportunities across our alternative platforms in real estate, private credit, and private equity. Real estate owners that were hoping to be bailed out by easier Federal Reserve policy are facing loan maturities in an elevated interest rate environment, and that is one of several factors driving potential deals across most commercial real estate asset classes. After several years of limited merger and acquisition activity, private equity funds and business owners needing to sell assets are finally coming to market at more reasonable valuations. It is also a challenging environment for private equity firms to raise new funds, so having capital to deploy is an advantage that we feel is critical. Finally, continued revenue growth should keep corporate defaults contained while higher short-term rates provide enhanced yields in private credit. We feel these strategies will continue to add value to portfolios through attractive returns and additional diversification and are excited about our pipeline in all three strategies.

The More Things Change…

It is a natural reaction to focus on the most recent headlines and market returns and come to the dramatic conclusion that the economic and market drivers of the past fifteen years have reversed. The fundamentals tell a more nuanced story. The US economy has structural advantages that should endure even in this uncertain policy environment, and US assets should remain attractive. However, it is true that our percentage of the global stock market capitalization has likely peaked, and that concentration may lessen over the next few years as investors rebalance their exposures.

We expect to continue our process of trimming from expensive growth sectors and allocating towards cheaper value sectors and will expand that effort to include our international investments. We will also continue to take advantage of opportunities in private markets while maintaining a reasonable cash reserve so accounts that need current distributions have a cushion to draw from and growth-oriented portfolios have liquidity to redeploy when markets hit their next pocket of turbulence.

In closing, we hope that you and your families have not been directly affected by the historic flooding and loss of life in the Texas Hill Country, and our thoughts and prayers go out to all who have been impacted in any way by this tragedy.

We hope you are able to enjoy the remainder of the summer, and please reach out if you would like to visit.

Sincerely,

![]()

Steve Sprengnether

President & Chief Investment Officer

scs@legacytrust.com

![]()

Brad Bangen

VP, Head of Private Markets